Omnisend’s latest consumer survey shows that Americans are returning to Chinese ecommerce giants Temu and Shein only months after fresh tariff announcements. Although 29% of respondents reported higher prices on Temu and 24% said the same about Shein, site visits, app installs, and shopping frequency have all surged – matching or surpassing 2024 levels.

Key findings:

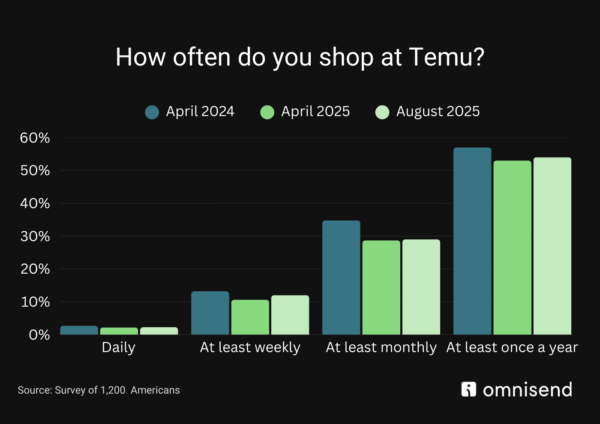

Temu comeback

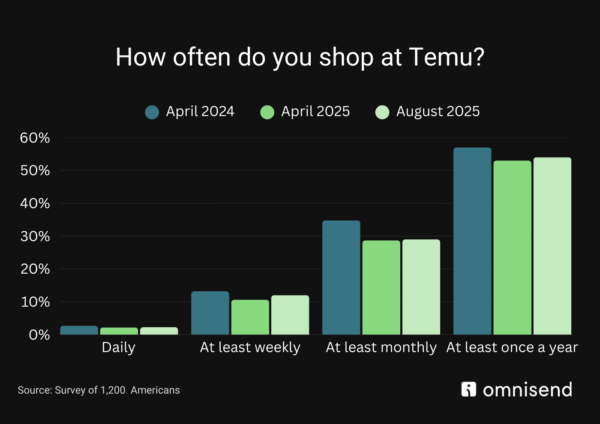

- 12 % of U.S. respondents now shop Temu weekly (up from 10.6 % in April 2025; just a bit shy of the 2024 high of 13.2 %).

- 28.5 % shop Temu monthly – holding steady since April, though still below the 34.8 % recorded in 2024.

- Similarweb shows +22 % month-over-month U.S. site visits, while Google Trends reports “temu” searches up 44 % last month.

Shein surges

- Weekly shoppers climbed to 12 % of US respondents in August 2025 (from 10 % in April 2025 and 11 % in 2024).

- 28 % of Americans shop at Shein monthly, up from 23 % in April and 26 % in 2024.

- Annual shoppers jumped to 48 %, compared with 39.8 % in April 2025 and 43 % in June 2024.

- Shein remains #1 in Similarweb’s U.S. Fashion & Apparel category and is the #2 most-downloaded shopping app nationwide; Google searches for “shein” grew 25 % last month.

Price pressure and the switching dilemma

“Tariff headlines and decreased ad spend on the Temu side caused a brief wobble, but value still rules,” says Marty Bauer, Ecommerce Expert at Omnisend. “Consumers are sensitive to price hikes yet remain willing to sift for deals – especially when coupons, free shipping thresholds, and social buzz offset perceived cost increases. U.S. brands aiming to compete should emphasize speed, simplified returns, and trust signals that Chinese marketplaces can’t easily replicate.”

Even with the rebound, survey respondents highlighted the factors most likely to push them away from Chinese platforms: 34% said further price increases would trigger a switch, while 24% cited faster shipping as a key lure elsewhere. Supporting domestic businesses, better customer service, and concern over data/privacy were lesser – but still noted – concerns.

Actionable tips for U.S. merchants competing with Temu and Shein

Marty Bauer provides some tips for U.S. merchants who want to attract some shoppers from Chinese platforms:

- Be present where deal-seekers already shop. List margin-friendly SKUs on leading marketplaces or partner with creators who showcase those channels so you intercept price-sensitive traffic without undercutting your own site.

- Outpace “China shipping” with speed and clarity. Offer same- or two-day delivery, real-time tracking, and no-hassle returns to erase the fulfilment advantage Chinese sellers often concede.

- Turn trust into your differentiator. Spotlight local sourcing, product quality, and sustainability in ads, packaging, and post-purchase emails to justify a higher ticket.

- Sweeten the deal—strategically. Use limited-time bundles, tiered loyalty rewards, and personalised SMS to deliver value without a blanket price cut. The easiest way to set those up is to use SMS automation tools like Omnisend.

- Leverage first-party data. Build segmented email/SMS flows that remind lapsed shoppers of faster shipping, easy returns, or loyalty perks whenever they browse Temu or Shein.

Methodology

The survey was commissioned by Omnisend and conducted by Cint in April 2024, April 2025 and August 2025. A total of 4,000 respondents were surveyed across 4 countries. Quotas were placed on age, gender, and place of residence to achieve a nationally representative sample among users.

OFFER

OFFER