According to a new survey by ecommerce marketing platform Omnisend, 46% of Americans say they support tariffs on imported goods, even as56% believe consumers ultimately bear the cost through higher prices. Compared to a year ago, support for tariffs has surged from 34% in 2025 to 46% in 2026, signaling a significant shift in consumer sentiment.

That awareness hasn’t slowed behavior change: nearly 70% of shoppers say tariffs influenced their shopping decisions, and 57.5% report making a conscious effort to buy more U.S.-made products over the past year.

“Consumers aren’t confused about tariffs – they know exactly where the cost shows up, and it’s on the receipt,” said Marty Bauer, Ecommerce Expert at Omnisend. “The survey showed that instead of simply shopping less to save money, people are shopping differently. They’re looking for fewer surprises, clearer pricing, and sellers they trust – and increasingly, that means choosing domestic options whenever they can.”

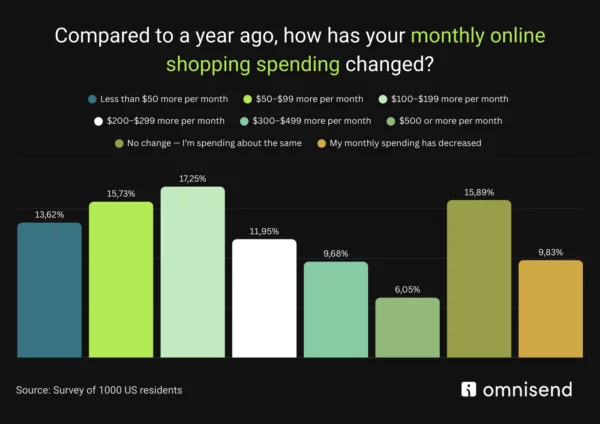

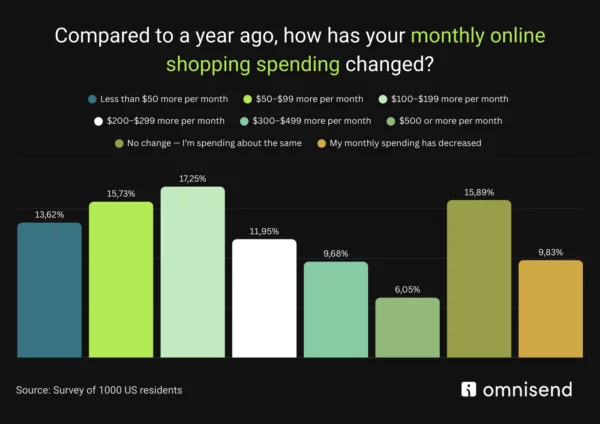

In practical terms, these shifts are already showing up in household budgets. Among consumers whose online shopping spending increased over the past year, monthly ecommerce budgets are now up by nearly $190 on average compared to a year ago, according to Omnisend’s analysis of the survey data. The increase reflects a combination of higher prices, tariff-related costs, and changes in purchasing behavior – including a greater willingness to pay modest premiums for U.S.-made goods.

Tariffs Are Reshaping Where Americans Shop

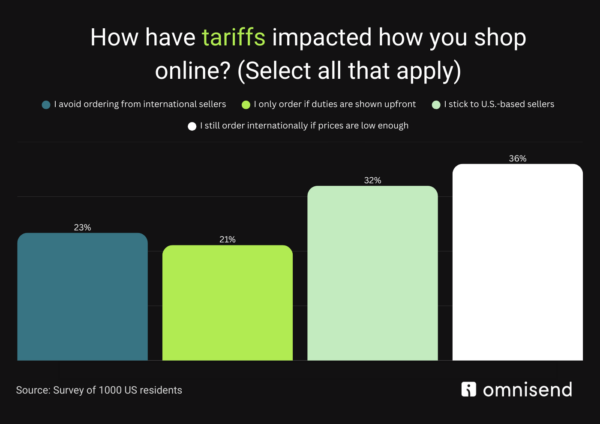

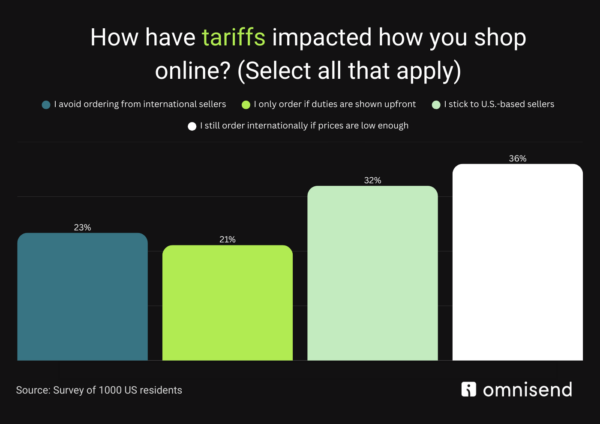

Tariffs are no longer a distant policy issue – they are showing up as everyday ecommerce friction. In response, 32.0% of consumers say they now stick to U.S.-based sellers, while 23.4% actively avoid ordering from international sellers. Another 21.1% say they only shop internationally if duties are shown upfront, underscoring how important pricing clarity has become. At the same time, global shopping hasn’t disappeared entirely: 36.1% say they still order internationally when prices are significantly lower.

“Tariffs didn’t kill cross-border ecommerce – they just raised the standard,” Bauer said. “When shoppers get hit with long delivery windows, surprise duties, or extra fees at the door, they don’t just complain. They change their habits. Predictability has become a product feature, and sellers that can’t provide it are losing ground.”

Buying American Is Rising — but Discovery and Trust Lag Behind

Interest in buying U.S.-made products is strong, but the survey shows that identifying them online remains difficult. Only 29.0% of shoppers say it is “very easy” to find and purchase Made in the USA products online, while 25.9% say it is somewhat or very difficult.

To compensate, consumers are doing more work themselves:

- 41.2% read product descriptions and labels more carefully

- 32.5% use marketplace filters or search terms

- 31.1% visit Made-in-USA–specific websites

- 18.7% contact brands directly to ask where products are made

Despite these efforts, 40.0% say they purchased a product they believed was Made in the USA only to later discover it wasn’t.

“When 4 in 10 shoppers say they bought something thinking it was Made in the USA and it wasn’t, that’s not a minor inconvenience – that’s a trust problem,” Bauyer said. “And trust is expensive to rebuild. If brands want to win in this environment, origin can’t be vague, buried, or implied. It has to be clear, consistent, and verifiable.”

Shoppers Will Pay More For U.S.-made Goods – but Only to a Point

The data shows consumers are open to paying a premium for U.S.-made goods, but tolerance is limited. 27.6% say they would pay up to 5% more, 21.9% would pay up to 10% more, and only 9.2% would accept a premium above 10%. Meanwhile, 29.8% say price matters more than product origin.

“This is where brands have to be careful,” Bauer said. “Yes, shoppers will pay more – but not indefinitely, and not without a reason they can understand. The winners will be the brands that pair a fair premium with clear value: transparency, reliability, and a shopping experience that doesn’t punish people with hidden costs.”

What Ecommerce Sellers Should Do Next

According to Omnisend, the findings point to clear steps ecommerce brands can take to adapt to tariff-driven behavior shifts:

- Make product origin impossible to miss. Clearly display where products are made and shipped from on product pages and filters.

- Lead with total-cost transparency. With 21.1% avoiding international purchases unless duties are shown upfront, hidden fees are a dealbreaker.

- Compete on predictability. Faster, more reliable delivery and clear returns policies now rival price as decision drivers.

- Explain price changes proactively. Email and SMS can help set expectations for shoppers who already believe consumers pay tariff costs.

- Treat trust as a conversion lever. With 40% experiencing Made-in-USA confusion, clear labeling is a competitive advantage.

“Tariffs have turned transparency into strategy,” Bauer added. “If you can show shoppers exactly what they’re paying, where the product comes from, and when it will arrive – you’re not just reducing friction. You’re building confidence, and confidence is what drives conversion when budgets are tight.”

Methodology

This Omnisend survey was conducted in January 10-14th, 2026 among U.S. consumers. Quotas were placed on age, gender, and place of residence to achieve a nationally representative sample of U.S. users.

The “nearly $190 more per month” figure represents a weighted average increase among respondents who reported higher monthly online shopping spending. Respondents selected spending increase ranges (e.g., less than $50, $50–$99, $100–$199, $200–$299, $300–$499, $500+). Omnisend calculated the average monthly increase by assigning a midpoint value to each range and weighting it by the number of respondents in each category. The $500+ category was calculated conservatively using $500 as the midpoint.

OFFER

OFFER