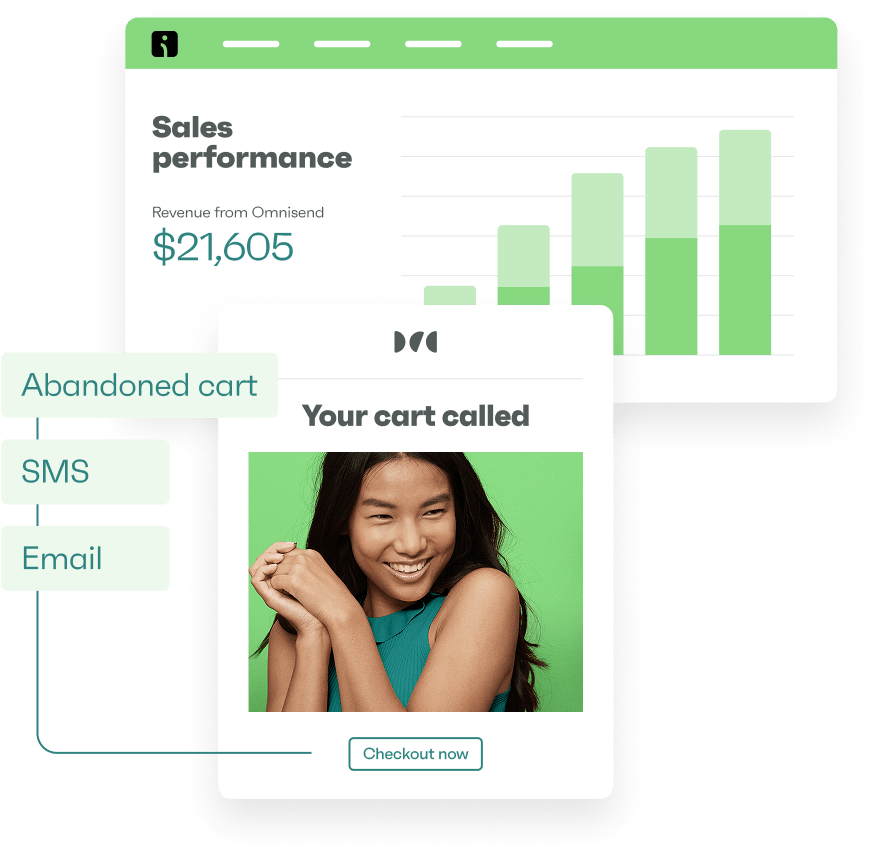

Drive sales on autopilot with ecommerce-focused features

See FeaturesRead summarized version with

Black Week has shifted from a busy shopping period to the week that defines the year for many ecommerce brands.

New data from Omnisend — based on 5,000 U.S. online stores — shows just how much revenue is now concentrated in the Monday–Sunday window around Black Friday.

A growing share of the year in seven days

This year, Black Week orders were up 36% compared to 2024. But the more telling change is how much of the annual volume now lives inside this single week:

- 16.6% of brands generated 30%+ of their yearly orders

- Nearly 10% of brands generated half or more of their yearly orders

- 31% of brands hit at least 15% of their yearly orders

- Average order value rose 30%, from $164 to $215

It’s a simple pattern: more orders, bigger baskets, tighter timing.

“Shoppers are waiting for deals they feel are worth it, and brands are pushing more of their offers into this week because costs are rising,” says Marty Bauer, Ecommerce Expert at Omnisend. “Tariffs and other expenses have eaten into margins, and month-long promotions just aren’t doable for some brands.”

Shoppers spent more — but more intentionally

Ahead of the season, U.S. consumers reported they would add nearly $20 billion in extra planned BFCM spend compared to last year. The actual shopping behavior reflected that intention.

Black Friday AOV grew to $215, up from $164. People bought fewer times, but they bought more per order.

“Instead of spreading purchases across the season, shoppers are consolidating,” says Marty. “It’s a practical response to higher living costs — get the best prices, save on shipping, move on.”

What this means going into next year

Black Week has become the structural center of the ecommerce calendar. With more revenue compressed into a single week, brands are treating it less like a promotion and more like a core operational milestone.

A few practical takeaways:

- Plan earlier: When 15–50% of annual orders may land in seven days, forecasting and inventory can’t wait for Q4

- Tighten the offer: Shoppers are selective, so clear, credible deals work better than scattered discounts

- Support bigger baskets: Bundles, thresholds, and simple shipping rules help customers consolidate without friction

- Use automations: High-intent traffic spikes in this window — abandonment flows and timely reminders do a lot of the work

Black Week is carrying more of the year than ever. The brands that treat it as a focused, planned event are the ones getting the biggest lift.

Methodology

Omnisend analyzed order and revenue data from 5,000 U.S. ecommerce brands, covering the period from January 1 to December 1 in both 2024 and 2025. Black Week performance was measured as the share of each brand’s total annual orders and revenue occurring during the Monday–Sunday window surrounding Black Friday. Consumer findings come from a survey of 1,000 U.S. adults, conducted ahead of the 2025 holiday season.

Want to dive deeper into the data?

Reach out to [email protected] for media inquiries or interviews.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER