Drive sales on autopilot with ecommerce-focused features

See FeaturesRead summarized version with

It’s beginning to look a lot like… budget season.

This year, people aren’t waiting until December to start shopping – and they’re not messing around with their money, either. Between inflation, tariffs, and the eternal dread of January credit card bills, holiday shoppers are starting early, watching budgets, and rethinking financing.

We asked 4,000 people in the US, UK, Canada, and Australia what their plans look like for the holidays. And here’s what came out of it.

Holiday habits at a glance

Holiday 2025 isn’t business as usual. Our survey shows just how much earlier, more cautious, and more calculated shoppers have become:

- Late October to mid-November is the prime shopping kickoff — ≈ one in three start then, while one in five begin before October

- $250–$499 is the most common spend range across all four countries

- AI is now part of the shopping toolkit, mainly used to hunt down deals

- BNPL goes mainstream – 40–45% across US, UK, Canada, Australia may use it

- Tariffs are reshaping US habits as 33.0% notice higher prices, 19.2% avoid international sites, 18.7% shop earlier

- Holiday debt lingers – ≈ 20% of adults across US, UK, Canada, Australia still carry last year’s balances

Now let’s go deeper into these findings.

People are shopping earlier – and planning harder

Let’s start with timing.

In all four countries, the most popular time to start shopping is late October to mid-November. Around a third of people said that’s when they kick things off – including 33.1% of US shoppers, 34.3% in the UK, 31.6% in Canada, and 26.1% in Australia.

Another one in five are starting before October even hits. That’s 23.0% in the US, 20.9% in the UK, 18.8% in Canada, and 19.0% in Australia. Very few people are leaving it until the last minute – around 4-7% across the board.

Black Friday and Cyber Monday are also still a thing, but not the main thing. Interest is highest in Australia at 24.7%, then Canada at 20.6%, the US at 18.9%, and the UK at 14.9%.

So it’s safe to say that it’s not a one-day sprint anymore. It’s a long, and a very careful jog.

BNPL and AI are both on the rise

With prices up pretty much everywhere, people are leaning into tools that help them feel more in control.

Because of this, BNPL (Buy Now Pay Later) is catching on fast. In the US and Australia, 44.8% of shoppers say they’ll use it or are thinking about it – with 18% of Americans saying yes, and another 26.8% saying maybe. The UK isn’t far behind at 41.8%, and in Canada, 36.6% are open to it.

Moreover, awareness is nearly universal – only 2.7% of US shoppers say they’ve never heard of BNPL, compared to 6.9% in Canada, 2.1% in the UK, and just 1.8% in Australia.

Basically, BNPL is now part of the holiday agenda. Most people know what it is, and a lot are planning to use it.

AI is also showing up in the shopping journey, mostly to sniff out deals. That’s the case for 28.0% of US shoppers, 27.7% in the UK, and 25.3% in both Canada and Australia. Gift ideas are the second most common use – about one in five shoppers in each country. Some are even letting AI write their messages or help with budgeting.

So, yes, Santa got automated.

Tariffs are changing behavior – at least in the US

A third of Americans – exactly 33.0% – say they’ve noticed higher prices due to tariffs. That’s already significant, but it goes further: 19.2% are avoiding international platforms altogether, 18.7% are starting their shopping earlier, and 16.3% are shrinking their gift lists.

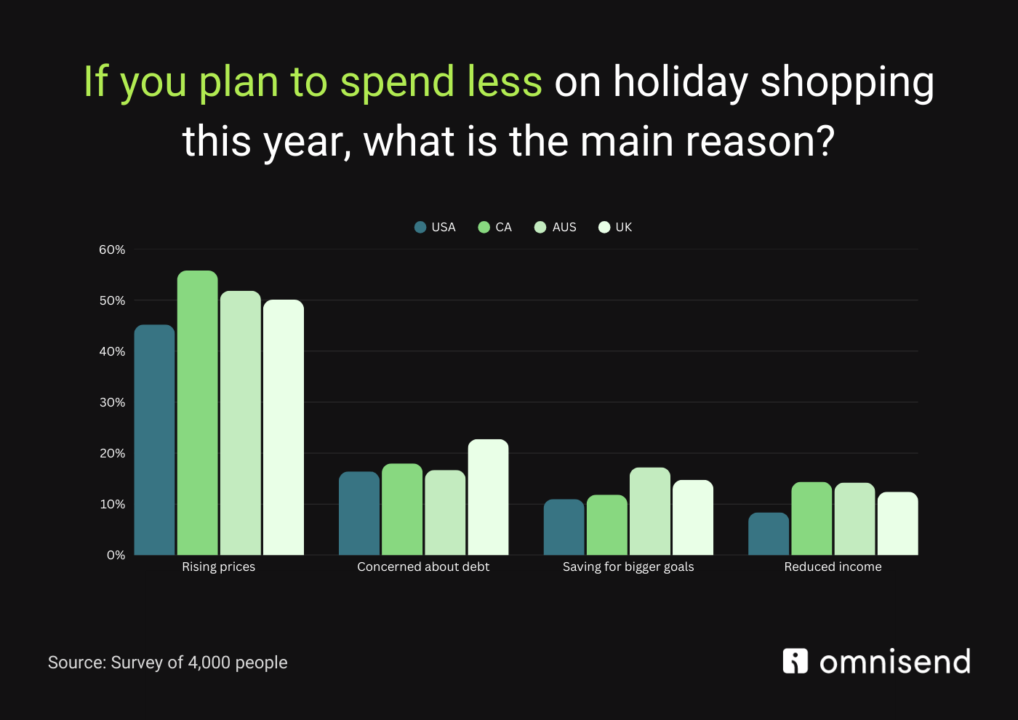

And there’s a bigger story here: around three out of four shoppers in every country say they’ll spend less this year than last. At the heart of this pullback lies, of course, inflation – called out by 55.8% of Canadians, 51.9% of Australians, 50.1% of Brits, and 45.2% of Americans.

In the US, tariffs are making things even worse – 19.1% say import costs are another reason they’re cutting back.

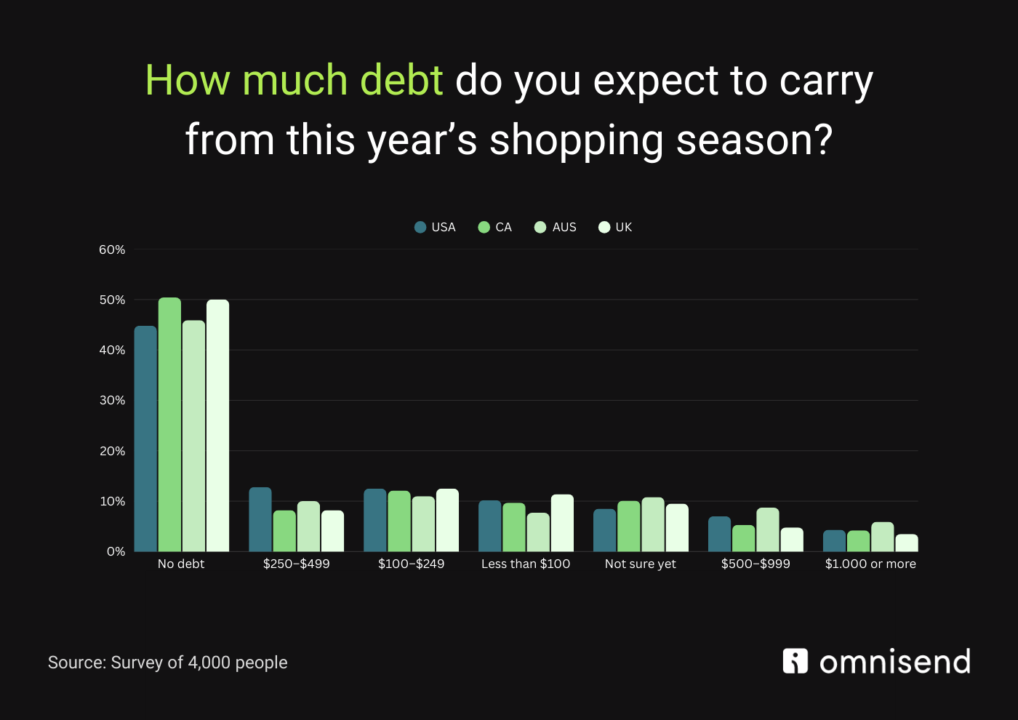

Debt is still part of the picture

Even with more planning, last year’s holiday spending left a mark.

In the US, shoppers racked up $55 billion in post-holiday debt – about $213 per adult. In Canada, it totaled $6.08 billion, or $187 per adult. Australians ended the season with $5.43 billion in debt, averaging $249 per adult. And in the UK, shoppers added £6.79 billion, which breaks down to about £171 per person.

That’s no small change. And it’s a big reason people are tightening up this year.

Where they’re shopping (and what they’re buying)

Amazon is still the default. No surprise there. But shoppers are exploring cheaper alternatives.

Temu is huge in Australia, with 32.2% of people using it – and it’s growing in Canada too, where 24.0% say they’ll shop there. eBay is still going strong, especially in Australia (36.9%) and the UK (30.2%). TikTok Shop is also on the rise – particularly in the UK, where 10.5% of shoppers are using it.

Top product categories?

Clothing is #1 everywhere. Tech leads in the US. Beauty and food are stronger in the UK. So yes – practical gifts, with maybe a few treats thrown in.

Holiday 2025 is quieter, earlier, and more calculated

People are still buying gifts. But they’re doing it differently:

They’re starting early, shopping around, using BNPL and AI here and there. They also tend to avoid international sellers if the price isn’t right. And most importantly – keeping budgets tighter than last year.

In fact, the most common spending range this year is $250–$499 – reported by 31.3% of Americans, 31.7% of Brits, 29.3% of Canadians, and 32.0% of Australians.

So if you’re a brand, the message is pretty simple:

Make it easy. Make it useful. And don’t assume people are in the mood to splurge.

This is a season of smart shopping – not just shopping shopping.

Want to dive deeper into the data?

Reach out to [email protected] for media inquiries or interviews.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER