Drive sales on autopilot with ecommerce-focused features

See FeaturesA year ago, we asked U.S. consumers how they felt about tariffs and whether those policies were changing how they shop. This year, we asked again — and the answers got more settled.

Support for tariffs increased from 34% in 2025 to 46% in 2026. And even with that support, those same shoppers aren’t expecting it to be cost-neutral: 56% say consumers ultimately bear the cost through higher prices.

So no, shoppers aren’t confused, and they don’t think tariffs are “free.” It’s more like, more people support them even while expecting prices to rise.

Tariff shopping habits at a glance

Here’s what stood out most:

- Support is up year over year: 46% back tariffs, up from 34% in 2025, while 56% say consumers bear the cost

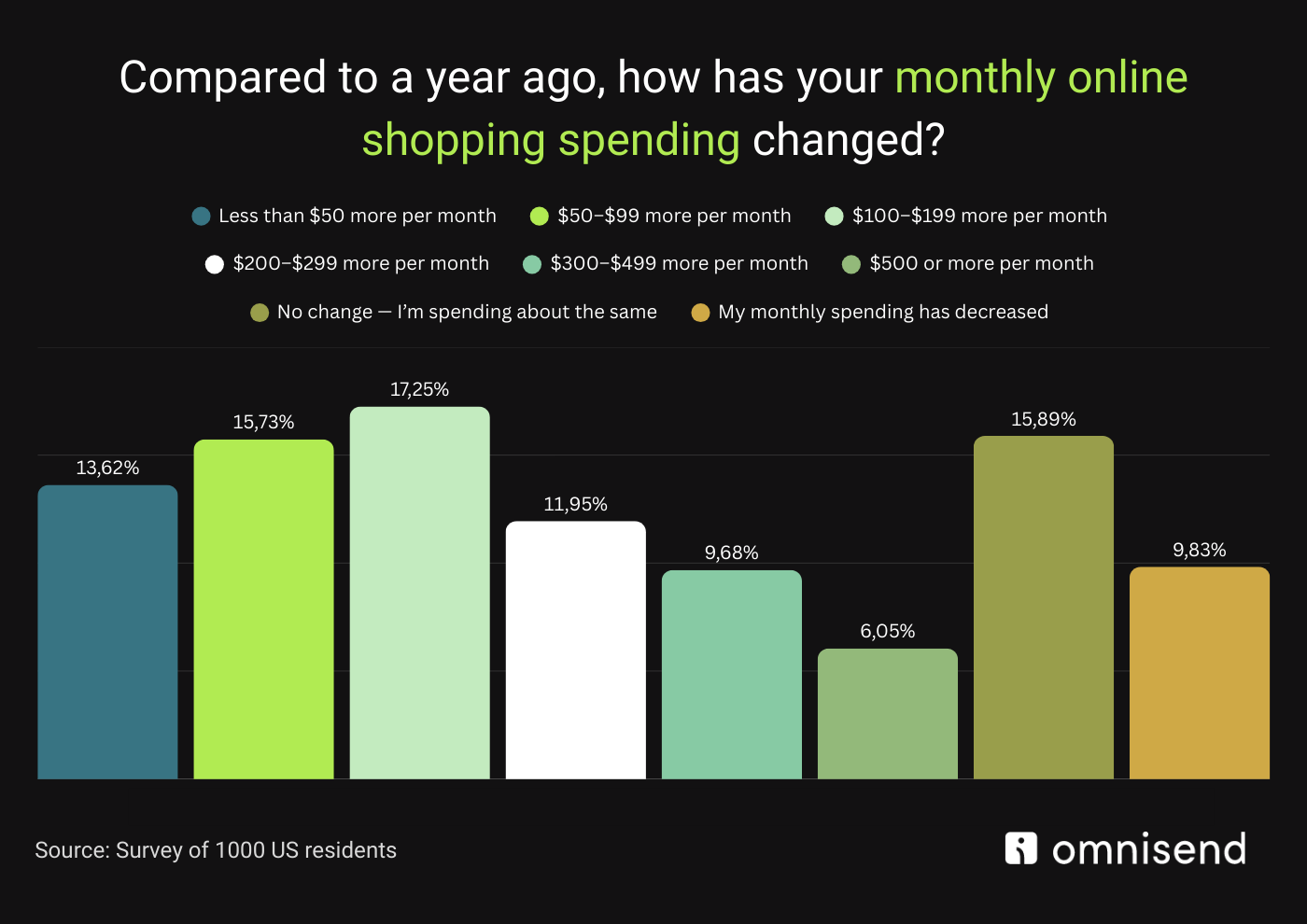

- Monthly budgets are up: Among shoppers who increased online spending, budgets rose by nearly $190/month on average (weighted midpoint calculation)

- Tariffs are driving “Buy American” behavior: 68.7% say tariffs influenced their decision to buy more “Made in the USA” products (33.0% “a lot,” 35.6% “somewhat”), and 57.5% made a conscious effort to do so in the past year

- Willingness to pay more is up: 59% would pay extra for U.S.-made goods (vs. 40.1% in 2025) — 27.6% up to 5%, 21.9% up to 10%, and 9.2% more than 10% — though 29.8% still prioritize price over origin

- Cross-border shopping creates real friction: When ordering internationally, shoppers report slower-than-expected delivery times (41%), unexpected duties or taxes (17%) at delivery, and additional handling or customs fees (24%) — experiences that are actively reshaping behavior

- Trust and transparency are major issues: 40.0% of shoppers say they bought a product they believed was Made in the USA only to later discover it wasn’t; 27.8% kept the product, while 12.3% returned it

What people believe vs. what they do

Even though many shoppers expect tariffs to raise prices, they aren’t necessarily cutting spending. Among consumers who reported that their online shopping spending increased over the past year, monthly budgets were up by nearly $190 on average (based on a weighted midpoint calculation).

That increase likely reflects a mix of factors, such as higher prices, tariff-related costs, and changes in purchasing behavior — including a greater willingness to pay modest premiums for U.S.-made goods.

“Consumers aren’t confused about tariffs — they know exactly where the cost shows up, and it’s on the receipt,” said Marty Bauyer, Ecommerce Expert at Omnisend. “The survey showed that instead of simply shopping less to save money, people are shopping differently. They’re looking for fewer surprises, clearer pricing, and sellers they trust — and increasingly, that means choosing domestic options whenever they can.”

Tariffs are reshaping where Americans shop

For many shoppers, cross-border ecommerce has become more complicated than it used to be, and that experience is changing habits:

- 32.0% say they now stick to U.S.-based sellers

- 23.4% actively avoid ordering from international sellers

- 21.1% only shop internationally if duties are shown upfront

At the same time, international shopping hasn’t disappeared. 36.1% say they still order internationally when prices are significantly lower. So the pattern here is pretty simple: shoppers will still buy across borders, but they’re less willing to deal with uncertainty.

“Tariffs didn’t kill cross-border ecommerce — they just raised the standard,” Bauyer said. “When shoppers get hit with long delivery windows, surprise duties, or extra fees at the door, they don’t just complain. They change their habits. Predictability has become a product feature, and sellers that can’t provide it are losing ground.”

Buying American is trending — but sellers don’t make it easy

Yes, consumers want to buy more U.S.-made products. But many of them struggle to find them online.

Only 29.0% say it’s very easy to find and purchase Made in the USA products online, while 25.9% say it’s somewhat or very difficult.

So shoppers do what shoppers always do when something matters to them — they start doing extra homework:

- 41.2% read product descriptions and labels more carefully

- 32.5% use marketplace filters or search terms

- 31.1% visit Made-in-USA–specific websites

- 18.7% contact brands directly to ask where products are made

Even with all that effort, 40% still say they bought something they believed was Made in the USA, only to later discover it wasn’t. Just an “oopsie” from the seller’s side?

“When 4 in 10 shoppers say they bought something thinking it was Made in the USA and it ultimately wasn’t, that’s not a minor inconvenience — that creates a trust problem,” Bauyer said. “And trust is expensive to rebuild. If brands want to win in this environment, origin can’t be vague, buried, or implied. It has to be clear, consistent, and verifiable.”

Shoppers will pay more for U.S.-made goods

Consumers are open to paying a premium for products made in the U.S. (which is great news if you sell them). 59% say they would pay a premium, up from 40.1% in 2025.

But they’re not open to paying any premium. Here’s what shoppers say they’d tolerate:

- 27.6% would pay up to 5% more

- 21.9% would pay up to 10% more

- 9.2% would pay more than 10% more

And nearly 29.8% say price still matters more than where the product is made.

So yes — “Made in the USA” can justify a higher price. Just don’t expect it to work as a blank check.

“This is where brands have to be careful,” Bauyer said. “Yes, shoppers will pay more — but not indefinitely, and not without a reason they can understand. The winners will be the brands that pair a fair premium with clear value: transparency, reliability, and a shopping experience that doesn’t punish people with hidden costs.”

What ecommerce brands should do next?

If tariffs are shifting behavior toward predictability, trust, and transparency, ecommerce brands have a pretty clear playbook here.

1. Make product origin impossible to miss

Don’t bury it in a dropdown or leave it “implied.” If you want to win shoppers who care about domestic products, make it obvious on:

- Product pages

- Collections

- Filters

- Onsite search results

2. Lead with total-cost transparency

With 21.1% avoiding international shopping unless duties are shown upfront, hidden fees are a conversion killer. If extra costs exist, don’t make customers discover them as if it’s a plot twist.

3. Compete on predictability (not just price)

The cross-border pain points are loud:

- 41% say delivery was slower than expected

- 24% faced handling/customs fees

- 17% got hit with duties/taxes at delivery

That means delivery speed, reliability, and return policies aren’t “nice extras.” They’re dealbreakers.

4. Explain price changes proactively

Consumers already believe they’re paying the tariff costs anyway. So if prices shift, don’t let that turn into silent resentment. Email + SMS can help set expectations before shoppers get to checkout.

5. Treat trust like a conversion lever

With 40% experiencing Made-in-USA confusion, clear labeling is a competitive advantage. Not because shoppers want a lecture. Because they want to buy something without feeling tricked.

“Tariffs have turned transparency into strategy,” Bauyer added. “If you can show shoppers exactly what they’re paying, where the product comes from, and when it will arrive, you’re not just reducing friction. You’re building confidence, and confidence is what drives conversion when budgets are tight.”

Methodology

This Omnisend survey was conducted January 10-14th, 2026, among U.S. consumers. Quotas were placed on age, gender, and place of residence to achieve a nationally representative sample of U.S. users.

The “nearly $190 more per month” figure represents a weighted average increase among respondents who reported higher monthly online shopping spending. Respondents selected spending increase ranges (e.g., less than $50, $50–$99, $100–$199, $200–$299, $300–$499, $500+). Omnisend calculated the average monthly increase by assigning a midpoint value to each range and weighting it by the number of respondents in each category. The $500+ category was calculated conservatively using $500 as the midpoint.

Want to dive deeper into the data?

Reach out to [email protected] for media inquiries or interviews.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER