Drive sales on autopilot with ecommerce-focused features

See FeaturesYour favorite online store hasn’t changed, but behind the scenes it’s paying more just to keep the digital shelves stocked.

Over the past year, new and ongoing tariffs have quietly raised the cost of importing everything from fabrics and electronics to packaging and parts. For big retailers, those extra costs can be absorbed, at least for a while. For smaller ecommerce brands, every percentage point matters — and there isn’t a huge cash buffer to fall back on.

To understand how they’re coping, Omnisend surveyed 200 U.S.-based ecommerce business owners in November 2025. We asked what tariffs have already forced them to change, and what they say they’d do if costs jumped again overnight.

Quick-glance findings

Here’s what small and mid-sized online retailers told us about how tariffs are reshaping their businesses — and your cart:

- Most stores have already had to adapt. 54% of online retailers say tariffs have forced them to make significant changes to how they price, source, or sell products.

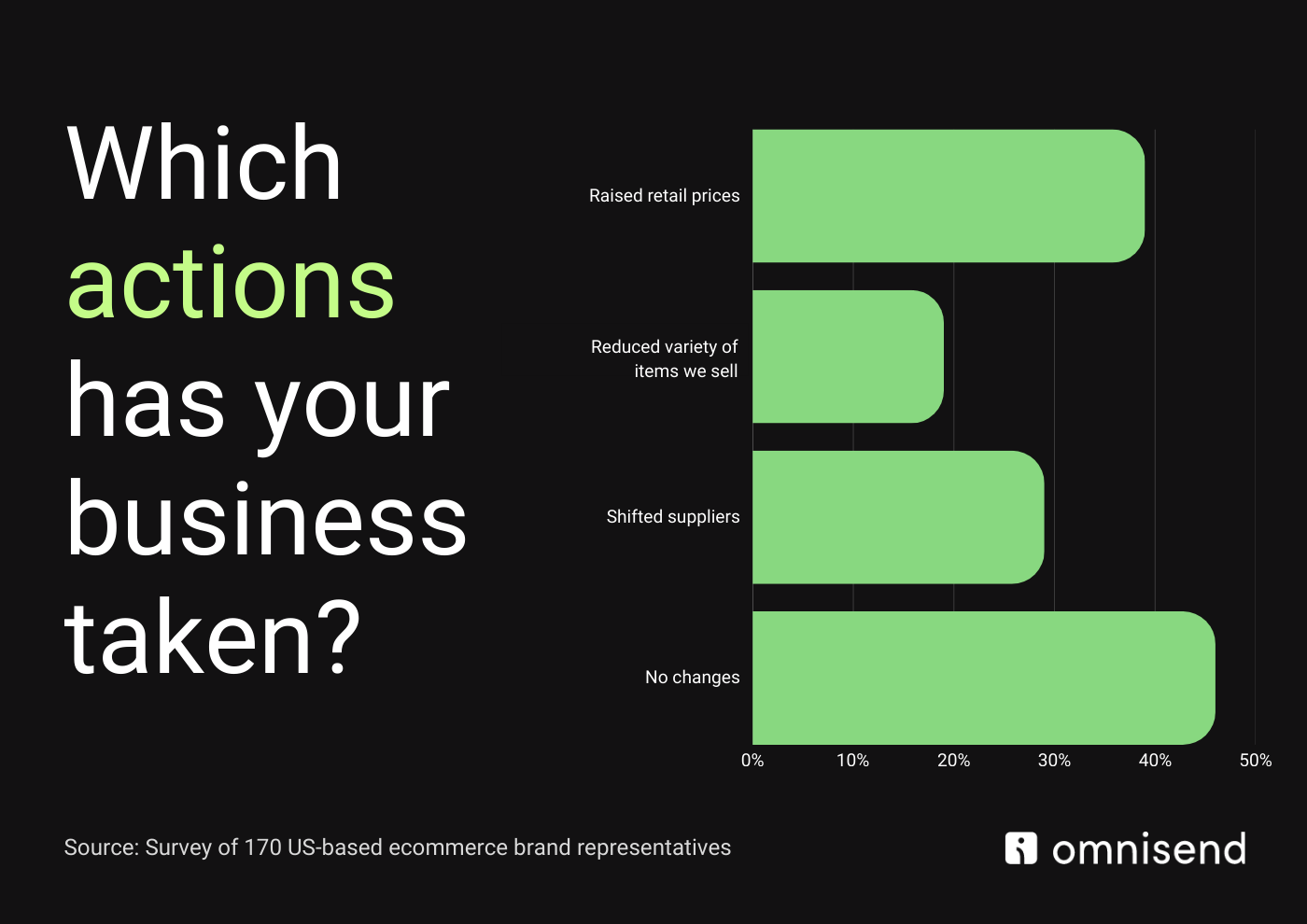

- Price tags are shifting. 39% have raised retail prices because of tariffs, while 29% have switched suppliers and 19% have reduced the number of products they sell.

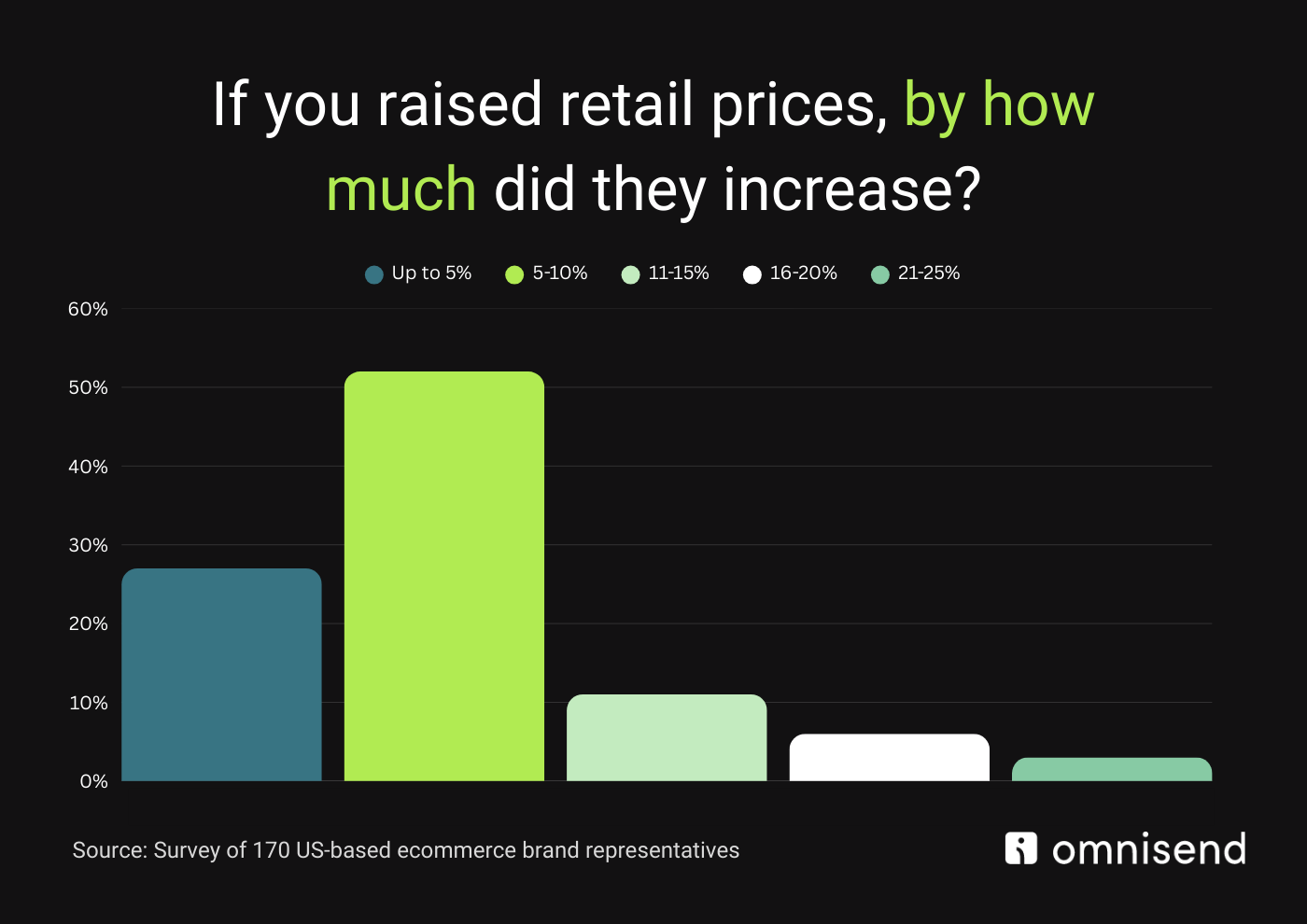

- Most increases are modest — some aren’t. Among retailers who raised prices, 27% increased them by up to 5%, 52% by 5–10%, and about 20% by more than 10%.

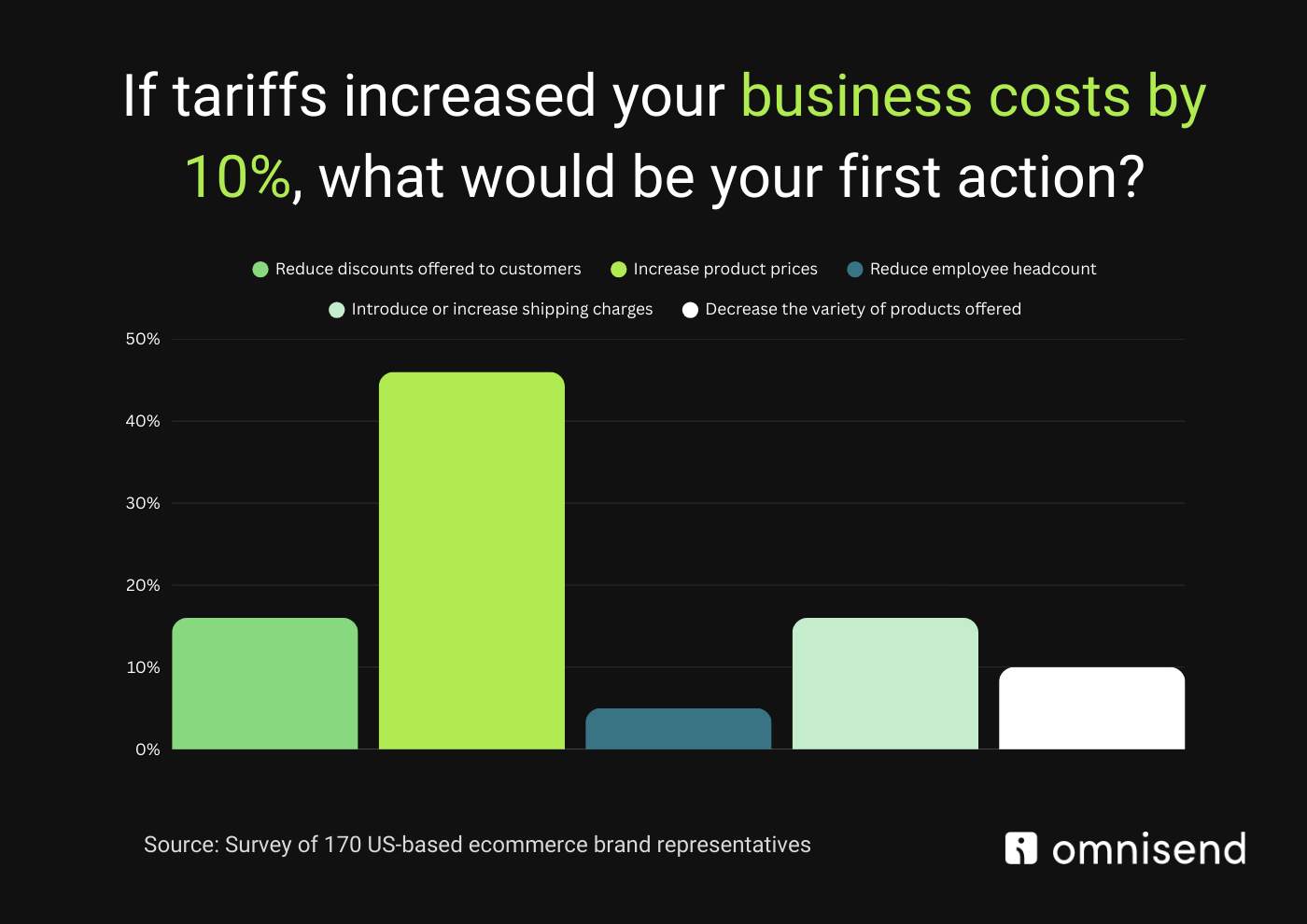

- If costs jump again, shoppers will feel it first. Faced with a 10% overnight increase in their own costs, 46% of ecommerce businesses say they’d raise product prices, 16% would add or increase shipping fees, and another 16% would cut discounts.

- Jobs are the last lever. Only 5% say they would look at reducing headcount first. Overall, 78% would make shopping more expensive in some way before they’d consider layoffs.

What tariffs have already changed for online stores

Tariffs aren’t a future risk for ecommerce brands — they’re already reshaping how online stores price, source, and stock their products. In our survey, 54% of online retailers say they’ve already made significant changes because of tariffs, from raising prices to reworking their supplier lists.

Higher costs are already in the price tag

For many brands, tariffs have moved straight into their pricing. 39% of surveyed businesses have raised retail prices because of tariffs, effectively passing at least part of the extra cost on to shoppers.

Among those who increased prices, most tried to keep hikes relatively modest — but they still add up in the cart:

- 27% raised prices by up to 5%

- 52% increased them by 5–10%

- and about 20% raised prices by more than 10%

Even if each product only costs a little more, across a full order it can feel like a noticeable jump.

“Tariffs are coming on top of already higher costs for shipping, labor and marketing, and most online retailers don’t have the same cushion big-box chains do. When your margins are thin, even a small increase in costs forces tough choices, and that shows up as higher price tags, fewer ‘free shipping’ offers, and certain products quietly disappearing from the site.”

— Marty Bauer, Ecommerce Expert at Omnisend

Quiet changes to suppliers and product ranges

Price is only part of the story. To manage higher import costs, 29% of retailers have switched suppliers, looking for better terms or products that aren’t hit as hard by tariffs.

At the same time, 19% have reduced the number of products they sell, which means some items simply vanish from virtual shelves — often without any announcement.

When tariffs push costs up, especially for smaller retailers, tweaking catalogs and supplier lists becomes a survival strategy. Instead of one big change, shoppers see smaller shifts: slightly higher prices, fewer free shipping offers, and a bit less choice each time they browse.

What happens if costs jump again

Tariffs have already pushed many retailers to adjust. But what if costs rose again overnight? We asked how businesses would respond to a 10% increase in their own costs — and the answer is clear: shoppers would feel it first.

Prices are the first lever

With a 10% cost spike, 46% of ecommerce businesses say they would raise product prices. For most online stores, the fastest way to stay afloat is to charge more at checkout. Often that means small increases across many products, but the result is the same: a higher total in the cart.

Shipping and discounts are next in line

If retailers aren’t raising product prices, they’re often looking at the extras around them. 16% of respondents say they would add or increase shipping fees, and another 16% would cut discounts if costs rose by 10%.

In practice, that means fewer promo codes, fewer blanket sales, and stricter rules around perks. “Free shipping” thresholds might move higher, certain locations might no longer qualify, and the codes customers are used to seeing in their inboxes could become less generous or less frequent.

Less choice on the shelf

A smaller but still significant share of businesses would respond by cutting back on what they sell. 10% say they would reduce product variety if costs jumped 10%.

Rather than closing entire categories, this often shows up at the edges: specific colors or sizes going out of stock and not returning, niche or lower-margin items disappearing from the site, and collections being quietly simplified so that inventory is easier — and cheaper — to manage.

Jobs are the last resort

When we look across all the responses, one thing stands out: only 5% of retailers say they’d consider reducing headcount first. Before cutting jobs, most businesses would prefer to adjust what customers see and pay.

Taken together, around 78% of retailers say their first move would be to make online shopping more expensive in some way — through higher prices, added fees, fewer discounts, or less choice — effectively turning tariffs into a direct cost for customers long before they show up as layoffs.

Tariffs: a hidden surcharge on online shopping

Tariffs are acting like a quiet surcharge on ecommerce. Instead of showing up as a separate line item, they’re pushing online stores to raise prices, trim discounts, and cut products long before they touch their staffing plans.

That leaves both sides under pressure. Retailers are working to protect already thin margins in a higher-cost environment, while shoppers are adapting to higher cart totals, fewer promo codes, and a bit less choice each time they browse.

For additional data cuts, charts, or interviews with Omnisend’s ecommerce experts, contact [email protected].

Methodology

- In November 2025, Omnisend surveyed 200 U.S.-based ecommerce business owners across a mix of sectors and company sizes.

- Respondents were asked if and how they had already changed their business because of tariffs.

- They were also asked how they would respond to a hypothetical 10% overnight increase in costs, including potential changes to pricing, shipping fees, discounts, product variety, and headcount.

- All figures in this article come from that survey.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER