Drive sales on autopilot with ecommerce-focused features

See FeaturesRead summarized version with

The British high street didn’t need more problems. Between River Island closures, M&S cyber attacks, and the usual cost-of-living squeeze, it was already losing foot traffic fast.

Now there’s another blow and it’s coming from Temu, Shein, TikTok Shop, and AliExpress.

New Omnisend data shows that 70% of British consumers now shop at Chinese marketplaces, up nearly 17% from last year. For context: that’s millions more people actively choosing low-cost online platforms over homegrown retailers.

And no, it’s not just one-off purchases. A fifth of British shoppers (19%) now say they shop at one of these sites at least once a week.

Quick-glance findings

Here’s what stood out from the August 2025 Omnisend survey of UK consumers:

- 70% of Brits now shop at Chinese marketplaces — up from 60% last year

- 19% do so weekly

- Temu leads with 55% of shoppers buying from it at least once, followed by Shein (52%), TikTok Shop (37%), and AliExpress (34%)

- Temu’s weekly shoppers hit 12% — or 6.5 million people nationwide

- Amazon and eBay were the only platforms to dip, both down just 1%

- 30% of shoppers say they’d stop using these platforms immediately if prices go up

- Only 2% say price doesn’t affect their shopping habits

Low prices are driving the shift, but loyalty is still up for grabs.

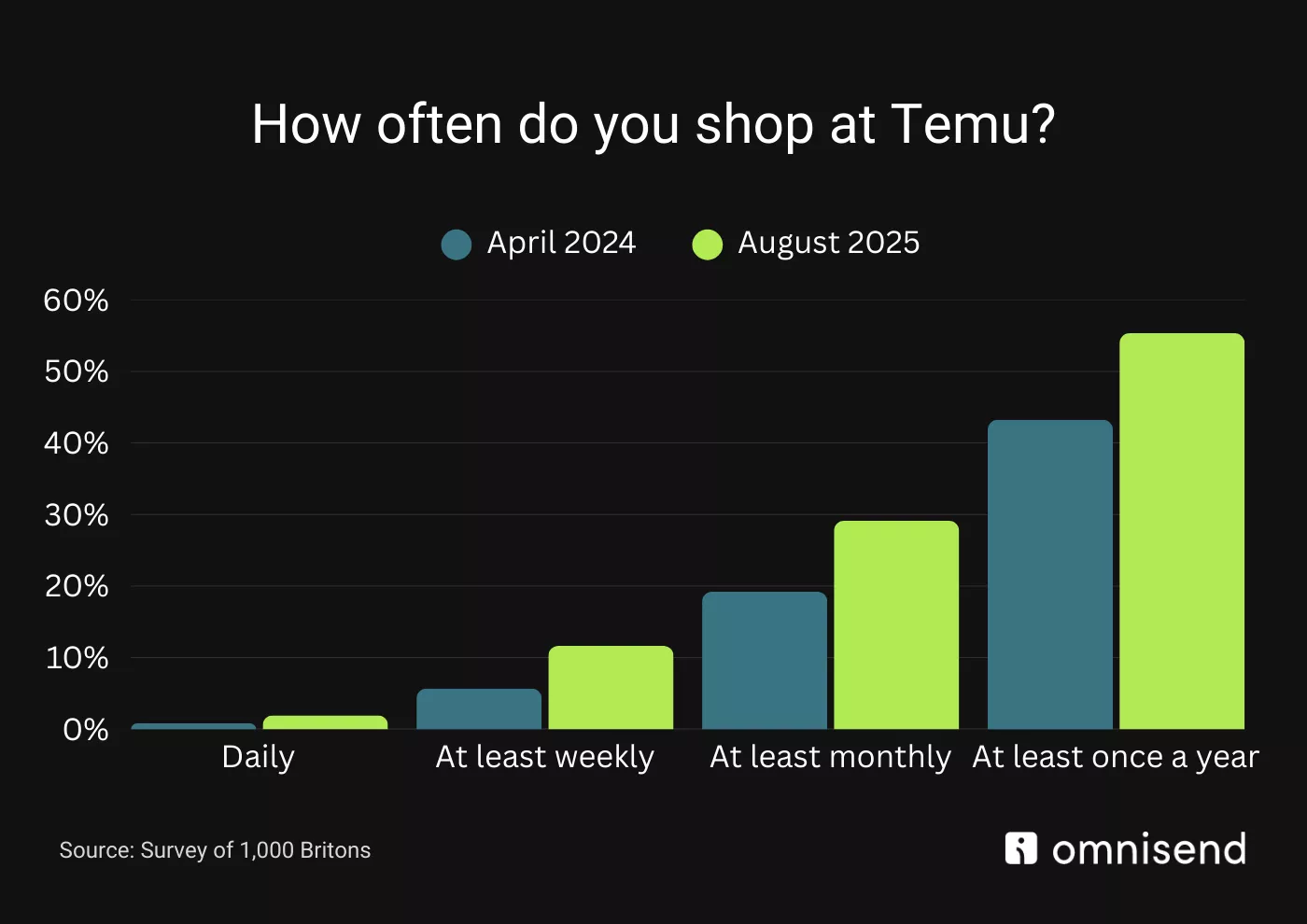

Temu takes the lead

Of the four major Chinese marketplaces, Temu is now the UK’s most popular. Over 6.5 million Brits — or 12% of the adult population — say they shop on Temu weekly.

In total, 55% of UK online shoppers have bought from Temu, up from 43% last year — a sharp year-over-year jump in overall reach.

The factors are predictable:

- Steep discounts

- Free shipping and freebies

- Endless scrolls of “TikTok made me buy it” deals

But underneath the dopamine hits, one thing still matters more than anything else: price.

Shein, TikTok Shop, and AliExpress follow close behind

While Temu may be leading, Shein remains a heavyweight with 52% of UK online shoppers buying from it in the past year — up from 42% in 2024.

It’s followed by:

- TikTok Shop — now used by 37% (up from 25%)

- AliExpress — now at 34% (up from 22%)

This isn’t niche behavior anymore. These sites are eating into time and spend once reserved for more traditional platforms and in some cases, the high street.

Even legacy giants aren’t immune. Amazon and eBay were the only two platforms in the study to see a drop in usage, albeit a modest 1% each.

No price, no loyalty

For all their growth, these platforms don’t have shoppers in a long-term relationship. It’s more of a situationship.

Three in ten shoppers (30%) say that if prices were to increase they would stop shopping ‘immediately’, while just 2% say they would continue regardless of cost.

Translation: value may be king, but it’s sitting on a very fragile throne.

This isn’t a passing fad

According to Marty Bauer, Ecommerce Expert at Omnisend, this shift is both cultural and structural.

“You only need to walk through your nearest town, or turn on the news, to see that online shopping has dramatically changed the face of the British high street. However, the rise of ultra low-cost Chinese marketplaces has presented yet another formidable challenge.

“While daily usage remains relatively low, the real growth is happening in monthly and weekly shopping patterns. This isn’t a passing fad — these platforms are becoming a regular part of consumers’ shopping routines.

“It is not just the attractive prices on offer that have made the likes of Temu and Shein become so popular, free gifts, customer offers and trending products and fashion have all encouraged this shift.”

Final takeaway

The rise of Temu, Shein, TikTok Shop, and AliExpress in the UK is a clear behavior shift. With 70% of Brits now shopping on these platforms, price has clearly won the first round.

But it’s not game over.

British retailers still have advantages Chinese platforms can’t easily replicate. It’s speed, service, and brand connection. The key is to stop fighting on someone else’s turf, and start reminding customers what it feels like to buy from someone who actually knows where Yorkshire is.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER