Drive sales on autopilot with ecommerce-focused features

See FeaturesRead summarized version with

Turns out, you can’t tariff away a good deal.

After months of headlines about price hikes and trade tensions, U.S. shoppers are heading back to Chinese marketplaces, and not slowly. New Omnisend survey data shows that Temu and Shein are both seeing a rebound in weekly and monthly shopping activity, along with a spike in U.S. search interest and app installs.

So what gives? It might come down to this: people still want the lowest price, even if it takes longer to ship and even if they noticed that it’s not quite as low as before.

Quick-glance findings

Here’s what we saw in the August 2025 Omnisend survey (U.S. data):

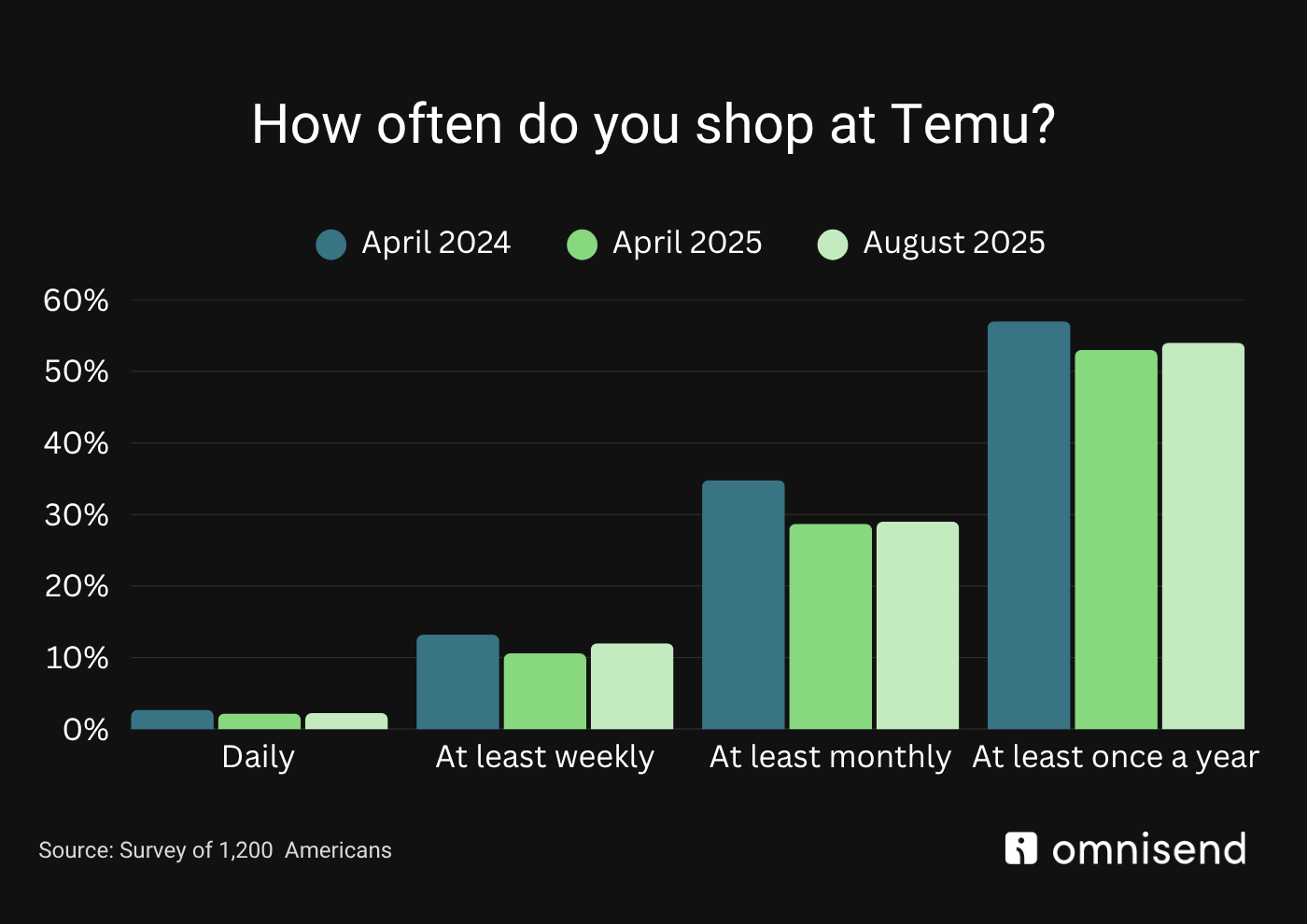

- Temu weekly U.S. shoppers are up 13% since April

- 28% of respondents are shopping on Shein monthly, surpassing 2024 levels (26%)

- Google searches for “Temu” surged +44% last month, “Shein” +25%

- 29% of users reported higher prices, yet shopping behavior is up

Temu’s bounce and Shein’s rise both suggest one thing: when prices go up, shoppers don’t leave, they just get pickier.

The Temu rebound

Let’s start with Temu. After a slight dip this spring, weekly U.S. shoppers have climbed back to 12% — a 13% jump since April and just short of its 2024 high of 13.2%.

Monthly usage is holding steady at 28.5%, and off-platform signals confirm the trend:

- +22% increase in U.S. site visits (Similarweb)

- +44% in Google search interest for “Temu”

So despite 29% of respondents reporting higher prices, traffic and usage are up. Shoppers may grumble, but they’re still clicking.

Shein keeps climbing

If Temu is bouncing back, Shein is straight-up accelerating.

Over the past few months, Shein has quietly pushed past its 2024 benchmarks and is now pulling ahead in nearly every category that matters: shopping frequency, app downloads, site visits, and search interest.

Here’s what the latest numbers show:

- Weekly shoppers hit 12% in August — up from 10% in April and higher than 2024’s 11%

28% now shop monthly, up from 23% in April and surpassing 2024’s 26% - Annual reach jumped to 48%, from 39.8% in April

And it’s not just survey data — Shein is dominating digital signals too:

- #1 in Similarweb’s U.S. Fashion & Apparel category

- #2 most-downloaded shopping app in the U.S.

- Google searches for “Shein” rose 25% last month

It’s obvious now that Shein not only holds its ground, but is growing past pre-tariff benchmarks.

Value beats friction (for now)

So why the rebound, even with the price hikes?

“Tariff headlines and decreased ad spend on the Temu side caused a brief wobble, but value still rules,” says Marty Bauer, Ecommerce Expert at Omnisend. “Consumers are sensitive to price hikes yet remain willing to sift for deals – especially when coupons, free shipping thresholds, and social buzz offset perceived cost increases.”

Still, that price sensitivity matters. The survey showed:

- 34% would switch away from Chinese platforms if prices go up again

- 24% would jump ship for faster shipping options

- Others cited better customer service, data/privacy concerns, or a preference to support U.S. businesses

What U.S. retailers should take from this

It’s clear that Chinese marketplaces aren’t going anywhere, but that doesn’t mean domestic brands can’t compete. According to Marty Bauer, the strategy isn’t to beat Temu or Shein at their own game, but to change the game entirely.

Here are four moves he recommends:

- Be present where deal-seekers already shop. List margin-friendly SKUs on leading marketplaces or partner with creators who showcase those channels so you intercept price-sensitive traffic without undercutting your own site.

- Outpace “China shipping” with speed and clarity. Offer same- or two-day delivery, real-time tracking, and no-hassle returns to erase the fulfilment advantage Chinese sellers often concede.

- Turn trust into your differentiator. Spotlight local sourcing, product quality, and sustainability in ads, packaging, and post-purchase emails to justify a higher ticket.

- Sweeten the deal strategically. Use limited-time bundles, tiered loyalty rewards, and personalised SMS to deliver value without a blanket price cut. The easiest way to set those up is to use SMS automation tools like Omnisend.

- Leverage first-party data. Build segmented email/SMS flows that remind lapsed shoppers of faster shipping, easy returns, or loyalty perks whenever they browse Temu or Shein.

Final takeaway

Tariffs may have slowed Temu and Shein down, but only briefly. Bargain hunters don’t stay away for long, especially when they’re used to scrolling for endless deals. Even as prices edge upward, shoppers are already finding their way back.

For U.S. retailers, that means the battle won’t be won on discounts alone. Shoppers also want speed, transparency, and trust in the brands they buy from. Deliver on those, and you’ve got a fighting chance at keeping their attention, even when low-cost giants are just a tap away.

Want the full dataset, charts, or to speak with Marty Bauer?

Reach out to [email protected] for more.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER