Drive sales on autopilot with ecommerce-focused features

See FeaturesRead summarized version with

In 2024, holiday sales kicked off as early as October. Amazon set the pace with “Prime Big Deal Days” on October 8-9, and Target followed with “Early Black Friday” deals from November 7-9 — both giving shoppers a head start on discounts.

In parallel, Omnisend’s November survey found that 37% of Americans planned to spend less on gifts this year. Combined with stretched-out sales and fewer, bigger purchases, it’s clear why getting in front of shoppers early was key.

Now, as BFCM has passed, with Black Friday recording $10.8 billion in online sales and Cyber Monday with an impressive $13.3 billion, we gathered some numbers to gain insight into how Omnisend’s merchants did this year. Join us as we take a look:

BFCM 2024 in numbers

Here’s how the BFCM week (November 24-December 2) looked for Omnisend merchants this year — all in plain numbers:

Campaigns sent

- Email: 1.13B emails with an average open rate of 27.94% and a click-to-conversion rate of 8.22%

- SMS: 19.1M messages with a click-to-conversion rate of 3.64%

- Push messages: 15.2M messages with a click-to-conversion rate of 4.66%

Automations sent

- Email: 24.9M emails with a 45.43% average open rate and a 26.45% click-to-conversion rate

- SMS: 809.3K messages with a click-to-conversion rate of 2.04%

- Push messages: 354.6K messages with a remarkable 50.71% open rate and a 24.18% click-to-conversion rate

Automation MVPs

- If there’s a star player in holiday marketing, it’s automation — these messages accounted for 30% of all email orders during November, with just 3% of sends

- The most email automations were sent on Tuesday, November 26, 2024, with a total of 3.96M delivered

- The automation with the highest click-to-conversion rate was the welcome automation, with a conversion rate of 63.66%, whilst the second place goes for abandoned cart — 44.57%

- The most sent automation type was also the welcome automation, with a total of 8.85M sends

- The automation type that generated the most orders was abandoned cart, with a total of 146.4K orders

- For SMS, automated messages outperformed campaigns, with a 0.28% conversion rate compared to 0.13%

- Nearly $3 million in SMS sales came during the Cyber 10, with automations driving 8% of that total.

Trends and consumer behavior

Daily campaign insights

Sunday, November 24, marked a strong start to Black Friday Week, with email sends surging 15% compared to the day prior. Black Friday itself saw the highest email volume globally, with 204.1M emails sent, followed by Cyber Monday’s 172M.

SMS made its presence felt too, with brands sending 28M messages in November, a 9% year-over-year increase. Black Friday accounted for $926K in SMS-driven sales, making it the most lucrative day for text-based marketing.

When shoppers hit “Buy now”

Shopping behavior during BFCM revealed interesting patterns. On Black Friday, email-driven orders peaked between 7 AM and 12 PM, with the 8 AM hour generating one-third more orders than the next closest hour. For SMS, the noon hour stole the spotlight, though most purchases happened earlier in the morning.

Cyber Monday showed a shift in habits, likely influenced by weekday routines. Email shopping reached its peak during lunchtime hours (12 PM–3 PM), while SMS orders dominated the late morning window (10 AM–12 PM). These insights underscore the importance of aligning email and SMS timings to capture sales throughout the day.

Revenue and AOV trends

Email sales increased by 4.4% YoY, generating over $88 million for US brands during the BFCM week.

However, the consolidated shopping trend was unmistakable. While overall order volumes dipped, the average order value (AOV) during BFCM week surged 55% YoY to $235.94, compared to $152.54 in 2023. This reflects a shift toward fewer, bigger purchases as shoppers sought value.

Automations vs. campaigns

In the U.S. Black Friday campaigns delivered — the overall revenue grew by 4.4% YoY. It looks like marketers focused on urgency, driving action during peak shopping days. However, campaign-driven revenue fluctuated throughout the week, compared to 2023.

Meanwhile, automations like welcome series and abandoned cart emails stayed steady, converting 15x better than scheduled campaigns and accounting for 30% of all email orders in November — with only 3% of sends. Unlike campaigns, their performance wasn’t tied to the hype of specific days, making it a reliable way to keep sales rolling all week long.

For US brands, during the BFCM week, automations generated $26 million in sales. Without automation, this money would have been left on the table.

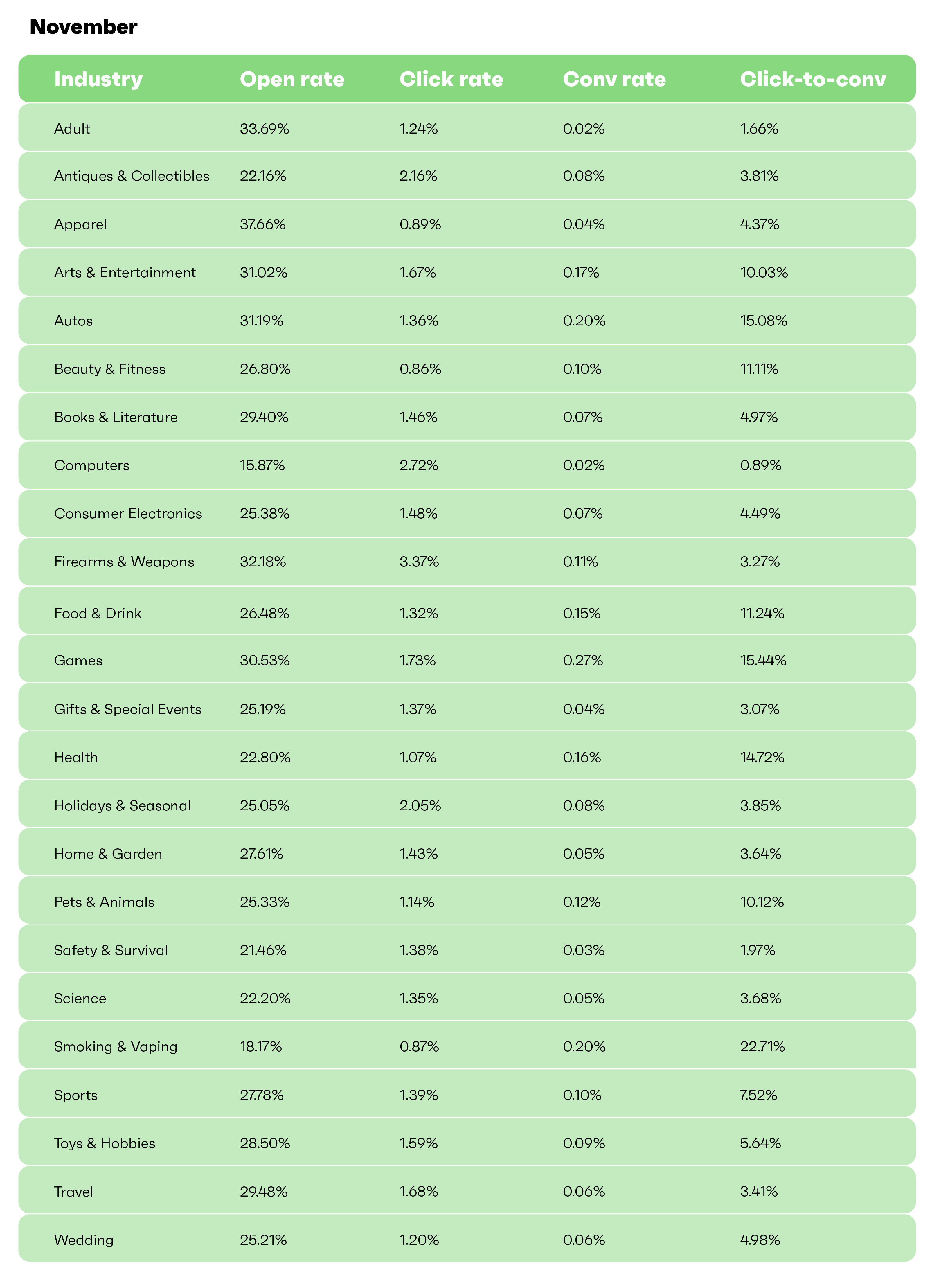

Industry performance breakdown

We wanted to see which industries stood out this shopping season, and the results are in: the Games industry came out on top.

In November, Games led the way with the highest conversion rate at 0.27%, followed by Auto and Smoking & Vaping (0.20%), Arts & Entertainment (0.17%), and Health (0.16%).

While industry performance naturally varies due to factors like product offerings and competition, there’s value in observing what the top-performing industries do right in their email marketing. Whether it’s leveraging social proof, incorporating compelling lifestyle visuals, or other tactics, identifying and adapting these strategies can give your own campaigns a competitive edge.

Wrap up

A lot went down this year and as we step into a season of analyzing and planning for the future, here are some lessons to take into account:

- Consider starting promotions early: The big guys do it, why shouldn’t you? Especially since it’s proven to be a successful strategy. And not only did early sales events capture consumer interest but also potentially helped retailers navigate supply chain challenges smoothly.

- Don’t skip on automations: The magic of automations is that once you set them up correctly, they work on autopilot, while you can focus on other aspects of your business. Classic flows like welcome emails and abandoned cart reminders consistently delivered strong conversion rates, proving that you don’t have to reinvent the wheel — just set them up and have a reliable revenue driver.

- Quality over quantity: It’s not a golden rule in all cases, but it looks like shoppers this year were focused on that. While order volumes dipped, higher average order values fueled revenue growth, so promoting premium products earlier in the week could be a winning strategy

This 2024 BFCM season highlighted the importance of adapting to shifting consumer habits. And while there is no “cure-all” recipe for success, let’s face it — focusing on early engagement, smart automations, and precise targeting will benefit mostly everyone.

Now, let’s count our wins and get ready for an even better 2025!

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

OFFER

OFFER