Drive sales on autopilot with ecommerce-focused features

See FeaturesYour cart total hasn’t changed. So why does your bank account feel $47 lighter this month?

You can thank tariffs.

Since the beginning of the year, tariffs have dominated the U.S. government’s trade agenda. The consequences are now showing up in familiar places: grocery budgets, online orders, and even where people choose to shop.

To understand how deep this goes, we surveyed 1,200 U.S. adults. The results were clear: besides just being a trade policy, tariffs are shaping daily decisions and reshaping the retail landscape.

Continue reading to find out what stood out.

What we found

Tariffs might sound like a government problem. But they’re showing up in regular people’s shopping carts and wallets. Our nationally representative survey revealed:

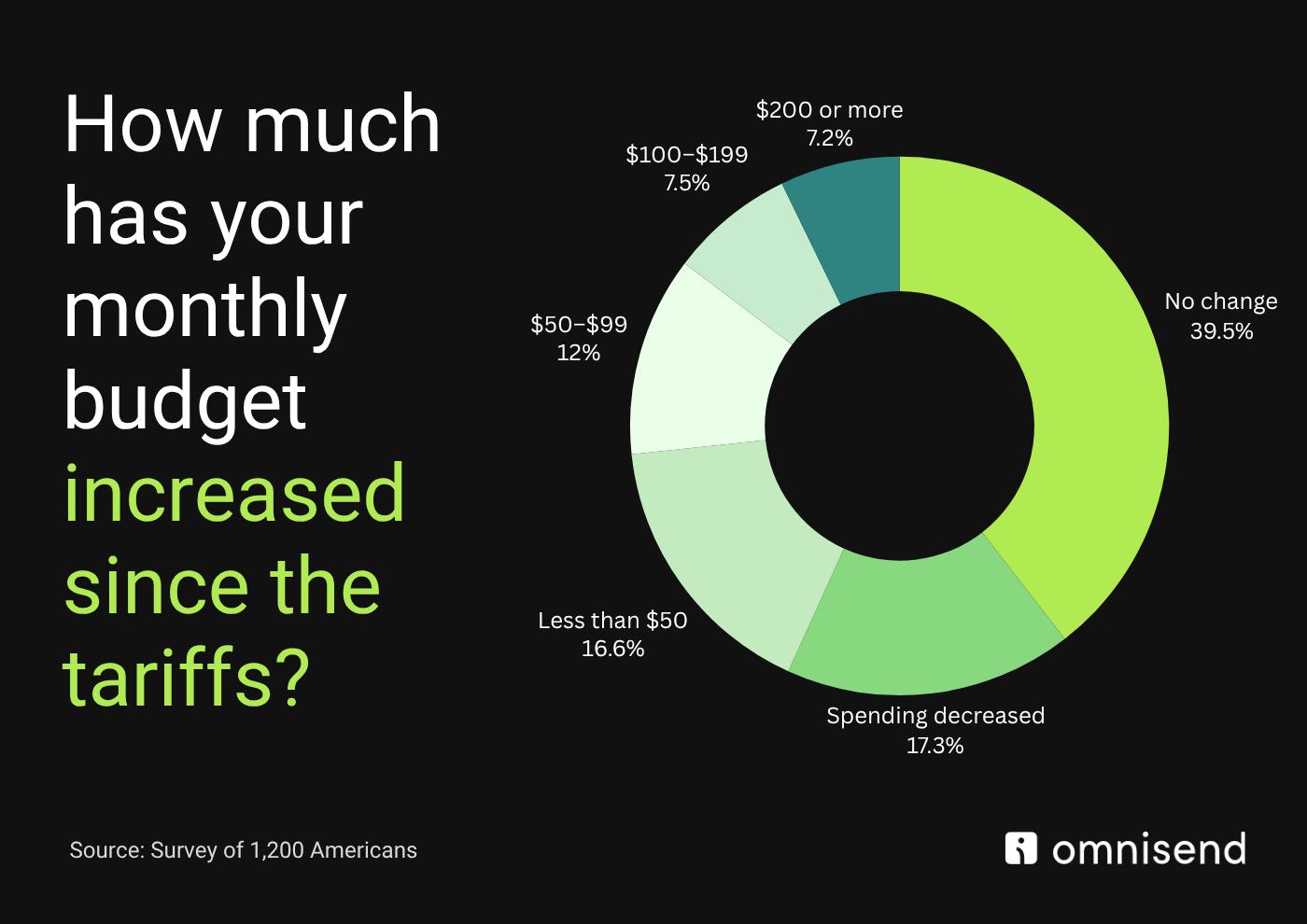

- Average US adult now pays $47 more per month, totaling ≈ $12.2 billion in new national spending

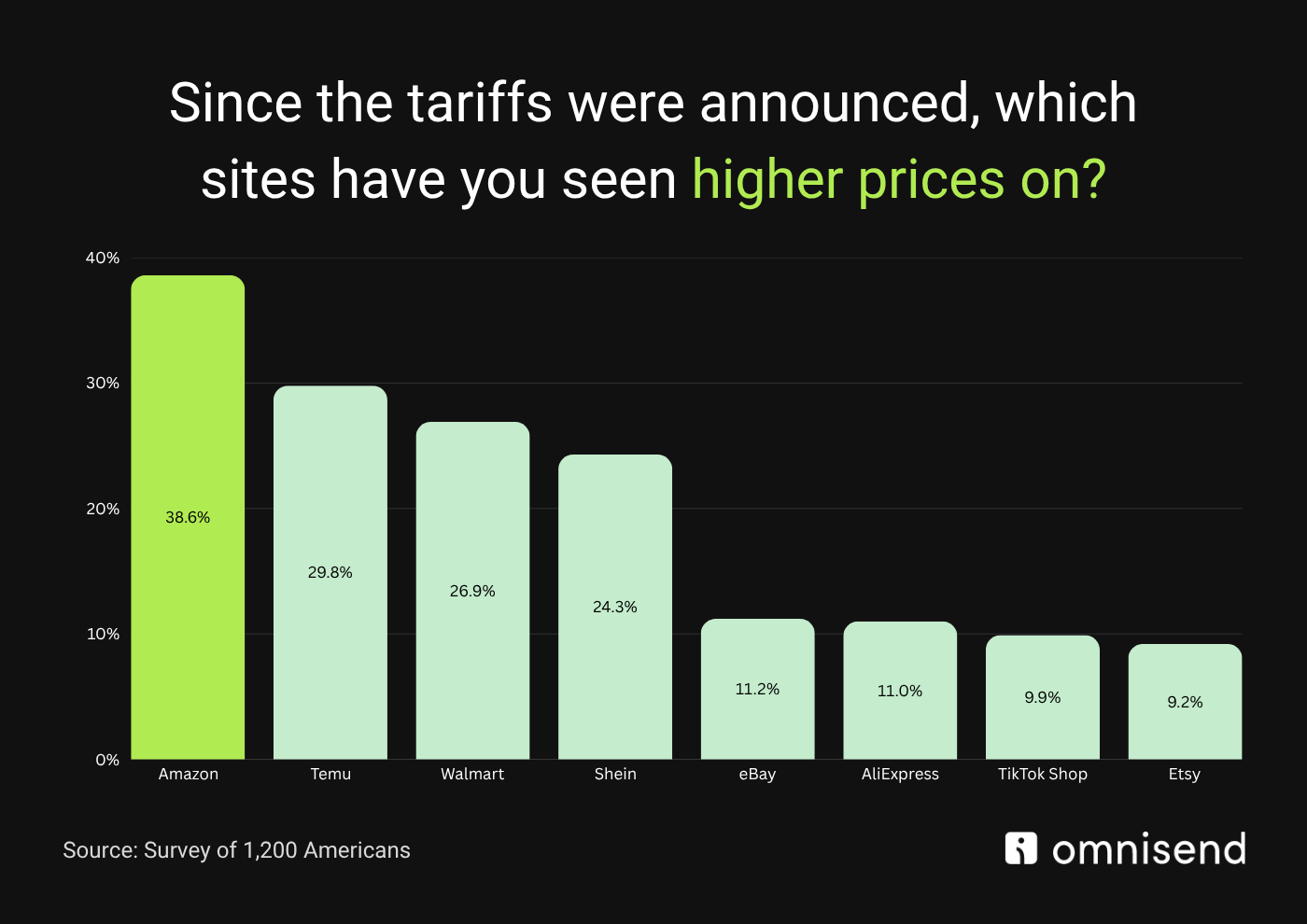

- 66% have noticed price hikes – Amazon (39%), Temu (30%), Walmart (27 ) top the list

- 68% have switched away from Chinese marketplaces and the price increase was the #1 trigger for 34% of them

- 1 in 7 households face $100+ monthly budget jumps

- 43% would pay more for U.S.‑made goods, 32% wouldn’t

- 23% have already purchased or are actively looking to purchase from Canada or Mexico to dodge price shocks and further 26% say they will if prices keep rising

Now let’s go deeper into these findings.

Americans are paying more — and they know it

That $47 average monthly jump may not sound painful at first. But zoom out, and it’s $12.2 billion bleeding from household budgets every month. That’s money not going into savings. Not going toward credit card debt. Not available for emergencies or even small indulgences.

And for 1 in 7 respondents, that monthly cost is $100 or more. Which means those ripple effects become waves, especially for lower-income families or anyone living paycheck to paycheck.

Top places where people are feeling the pinch:

- Amazon: 39%

- Temu: 30%

- Walmart: 27%

Public opinion is mixed. 49% say the tariffs aren’t worth the price squeeze. 28% support the policy. The rest is caught in the middle, likely adjusting habits day by day.

Shoppers are changing where they click

When prices go up, loyalty goes down. 68% of Americans are shifting away from Chinese ecomm giants like Temu, Shein, and AliExpress — a clear signal that low prices, not brand loyalty, kept them around.

Here’s where carts are rolling instead:

- Amazon: 64%

- Walmart: 49%

- Local small businesses: 27%

There’s also a ceiling to patriotic spending. While 43% of shoppers say they’re open to paying more for U.S.-made products, 32% aren’t buying the “Made in America” premium.

And it’s no longer about switching brands — we’re talking switching countries. 23% of shoppers are already buying from Canada or Mexico to get around the added costs. Another 26% say they’re close to doing the same if prices keep climbing.

It’s not just about money

The survey paints a clear picture: these tariffs are functioning like a stealth tax, reallocating billions in spending and reshaping consumer behavior in real time. Whether that shift is a patriotic flex or a budget-driven necessity depends on who you ask.

But one thing’s certain: American shoppers are adjusting fast.

Want to dive deeper into the data?

Reach out to [email protected] for media inquiries or interviews.

TABLE OF CONTENTS

TABLE OF CONTENTS

No fluff, no spam, no corporate filler. Just a friendly letter, twice a month.

Join our free online sessions to learn more about email marketing & sms and get your questions answered live.

Explore webinars

OFFER

OFFER